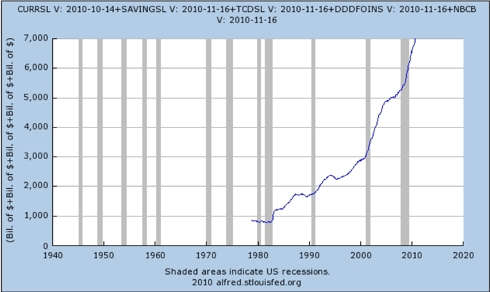

The best measure of the money stock in the economy can’t be found on some federal reserve or other government agencies website, for they publish various money stock figures that either include items that aren’t money, leave items out that are or have nothing to do with the money altogether. This money stock measure is known as the TMS or True Money Supply. This measure is superior because it represents the amount of money in the economy that is available for immediate use in exchange. It only counts immediately available money for exchange without prescribing to the errors of the Federal Reserve’s money supply measures such as double counting. It also excludes Money Market Mutual Funds (MMMF) because these investments must be sold in exchange for money first. Time deposits are also excluded from this measure as they are also not immediately available for use in exchange.So what does the TMS consist of?

1. Currency Component of M1

2. Total Savings Deposits

3. Total Checkable Deposits

4. U.S Government Demand Deposits

5. U.S Government Note Balances

6. Demand Deposits Due to Foreign Commercial Banks

7. Demand Deposits Due to Foreign Official Institutions

The Following Is the Most Current Measure of This Money Stock: 7.016 Trillion

(More on the TMS Later) As we all know unnecessary increases in the supply of money and credit lead to rising prices. Though we have seen a modest rise in prices despite what the misconstrued C.P.I tells us, inflation has already begun to a modest degree (for all those who have been to the grocery store lately, prices are rising), but it takes time to fully work its way into the system as expectations play a large role. It also takes time for all the enacted government policies to work its way to the TMS, thus this should be considered a very conservative estimate of the inflation already created. We can’t just assume the rise in this money stock is an exact measure of inflation as increases in productivity negate this to some degree.

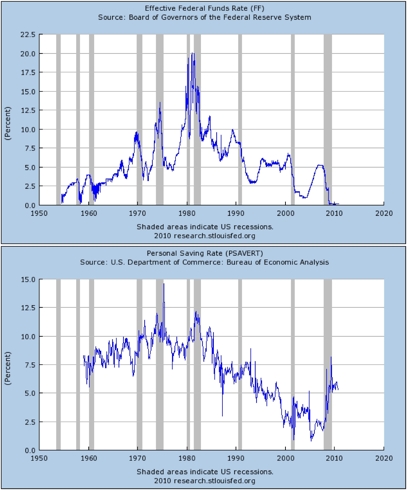

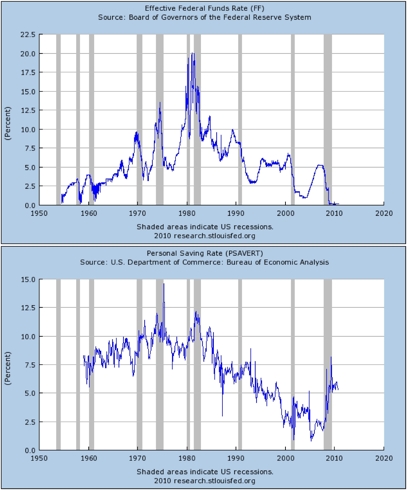

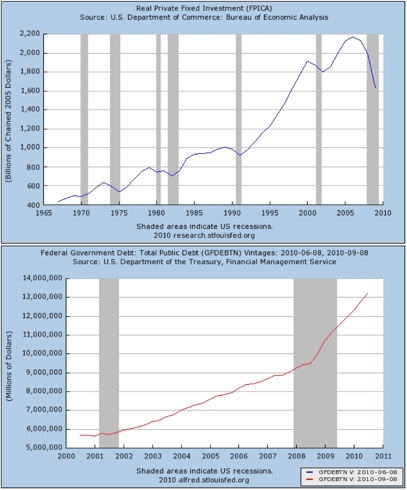

Why is the money stock growing at such a high rate during an economic contraction? Well it wouldn’t be outrageous to assume we have actually become less productive since the year 2000 as we have enacted policies that actually destroy capital formation such as easy money/cheap credit via artificially low federal funds rates. This distorts the collective time preferences of society causing misallocations of capital. To further understand this point, the following passage by Hans Herman Hoppe makes it much easier to understand.

“The most direct indicator of social time preference is the rate ofinterest. The interest rate is the ratio of the valuation of present goods as compared to future goods. More specifically, it indicates the premium at which present money is traded against future money. A high interest rate implies more “present-orientedness” and a low rate of interest implies more “future-orientation.” Under normal conditions — that is under the assumption of increasing standards of living and real money incomes — the interest rate can be expected to fall and ultimately approach, yet never quite reach, zero, for with rising real incomes, the marginal utility of present money falls relative to that of future money, and hence under the ceteris paribus assumption of a given time preference schedule the interest rate must fall. Consequently, savings and investment will increase; future real incomes will be still higher, and so on.

In fact, a tendency toward falling interest rates characterizes mankind’s super secular trend of development. Minimum interest rates on ‘normal safe loans’ were around 16 percent at the beginning of Greek financial history in the sixth century B.C., and fell to 6 percent during the Hellenistic period. In Rome, minimum interest rates fell from more than 8 percent during the earliest period of the Republic to 4 percent during the first century of the Empire. In 13th century Europe, the lowest interest rates on ‘safe’ loans were 8 percent. In the 14th century they came down to about 5 percent. “[1]

The prevailing interest rate is a mechanism that relays to investors whether or not to invest capital and at what stage of production maximizes future profit. Not to say it is perfect as many would incur losses, but due to their poor forecasting abilities not false market signals. Government artificially lowering the interest rate therefore leads to significant amount of malinvestment as these investments originally deemed profitable, only appeared that way due to a distortion of time preferences. For example low interest rates (In a free market) signal the demand for money is low and people are more savings oriented. This is seen by entrepreneurs who either modify their current allocation capital into those stages closest final production and shift it to stages further away from final production (more capital intensive goods that when finished provide a higher profit margin and total return on investment or it would have never been taken on in the first place). This is only a brief and incomplete description of capital theory but it is meant to convey the basic premise that the rate of interest plays an important role in all economic activity and also the most accurate explanation of why the boom-bust cycle occurs (which is a whole paper or book on its own).

The market signals alluded to in the previous passage provide other pertinent information as well. The prevailing rate of interest instructs and advises an economy the fastest way to end any economic situation. In other words, if the real rate of interest is very high, the remedy is to save your way out of recessions, not spend or print our way out. The free market is trying to convey that message, as we have seen numerous occasions when the FED was forced to inject capital into the banking system in order to suppress interest rates which the free market was trying to push up, telling us to save (high interest rates decrease the demand for money). In a free market the interest rates in the dot-com and housing bubbles would have steadily increased (as the demand for money was obviously through the roof but interest rates were low), preventing a bubble from forming in the first place.

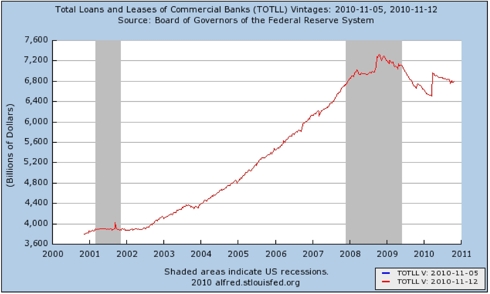

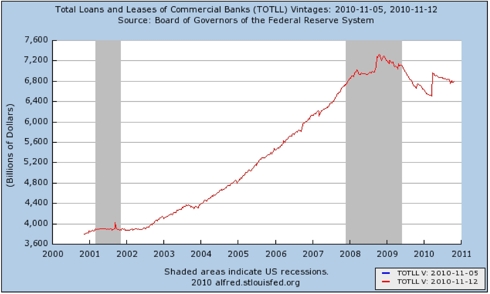

As one can see, by manipulating the prime rate, social time preferences indeed become distorted. When Greenspan and Bernanke were at the helm of the central bank, easy money reigned supreme thus causing the savings rate to decline to next to nothing. That encouraged loans that would not be otherwise originated to be given to an individual who lacks the means of repaying their loans. We are now at record mortgage defaults thanks to all the cheap credit leant out and still outstanding.

“The maintenance of short-term interest rates at too low a level, by governments or central banks, is one of the main explanations of the continuance of inflation. Excessively low rates always encourage over borrowing, which means an expansion in the supply of money and credit, which in turn causes commodity prices to rise even further. It is possible, of course, for a government or a central bank to keep money rates low for a long time, either by printing money directly or by permitting the over borrowing and consequent expansion of credit to which excessively low money rates inevitably lead. What is less well understood is that cheap money cannot be continued indefinitely. It sets in motion forces that eventually drive interest rates higher than if a cheap-money policy had never been followed. The expansion of money and credit that is necessary to hold interest rates down also raises commodity prices and wages. Higher commodity prices and wages make it necessary for businessmen to borrow correspondingly more in order to do the same volume of business. Therefore the demand for credit soon increases as fast as the supply. Later on, still another factor comes in. When both borrowers and lenders begin to fear that inflation is going to continue, prices and wages begin to go up more than the increase in the supply of money and credit. Borrowers want to borrow still more to take advantage of the expected further rise in prices, and lenders insist on higher interest rates as an insurance premium against expected depreciation in the purchasing power of the money they lend.”[2]

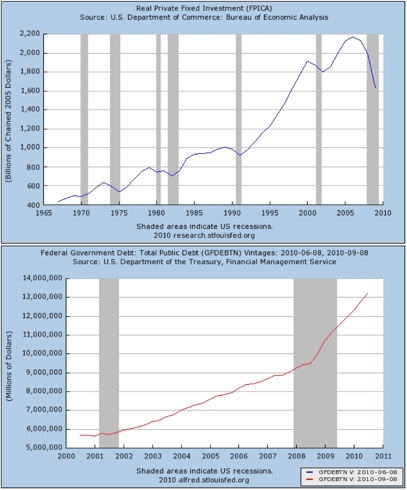

What are the consequences of such actions? Savings is equal to investment, so if we have next to no savings, how will capital formation come about? Well it won’t and the quantity that does is often misallocated into the wrong part of the structure of production. Additionally, because the USD is the world’s reserve currency, it is assumed our bonds are risk free, a big mistake for whoever owns any U.S debt. The aforementioned monetary policies coupled with our reserve currency status have allowed us to accumulate a massive debt burden that can never be paid off.

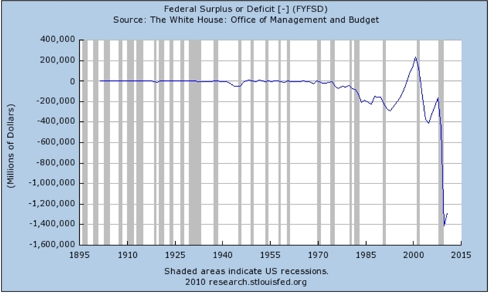

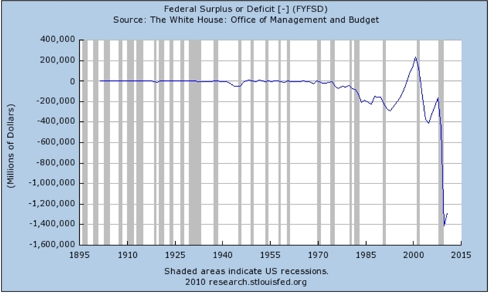

The explosion of the true money supply courtesy of easy money & credit, bailouts, QE(1) and QE(2) coupled with our massive future unfunded liabilities (NPV = Approx 100T) and our enormous debt burden makes it nearly impossible to contract the supply of money. This is because our cost of servicing this debt will increase dramatically (into the trillions per year) which would only increase our record budget deficits by forcing us to monetize our debt. But this is a catch 22 as even if they decided to do so, these deficits would become even bigger, with the public and foreigners alike not wanting to purchase junk assets on the open market (the fed contracts the money supply through the sale of securities via open market operations). So they are stuck between a rock and a hard place. It is becoming clear they are unwilling to purposefully send the U.S into a deep recession, which would be one way of avoiding a hyperinflationary episode and resuming real economic growth.

The Cure: Well there is only one real long term solution, that of course reverting back to a 100% gold standard. This is only way to avoid the fiat money house of cards from crumbling. Of course we could continue for several more decades on a fiat money system if the government decided to slash spending, cut medical programs among other costly policies, let the interest rate float and be determined by the market and stop accumulating and/or monetizing debt. These actions would cause the deficit to decline over time, our trade deficit to reverse, the market rate of interest to spike to astronomical level causing the savings rate to do the same and thus capital formation to occur which is the catalyst for job creation and real economic growth. Our currency would also appreciate, making owners of our debt less skeptical regarding whether we will actually repatriate these funds in the future.

The Reality: This is all highly unlikely to occur and we will see a continued explosion in the true money supply, eventually resulting in a hyperinflationary episode during the current decade. Both the Federal Government and The Federal Reserve are doing the exact opposite of what it truly needed thus it is up to us as individuals to take matter into our own hands are preserve what wealth we have. This of course, is owning real assets such as precious metals, agricultural products, energy, etc as the value of these goods will increase faster than the rate of inflation or in our case, protect us from a complete destruction of our wealth via a failed currency. Don’t believe the propaganda saying GDP figures show signs of an economic recovery or "This policy will create X amount of jobs". That is the same as saying tax receipts will go towards paying individuals to dig a ditch, only to have others fill it back up. JOBS DONT MATTER UNLESS THEY ARE PRODUCTIVE. This being the case there is no way GDP has rebounded from levels seen as far back as 8-10 years ago. Yes, the numbers may be higher but look at the composition: 70% consumption, defense spending, other government spending etc. Given the lack of technological innovation to any meaningful degree over the past ten years, coupled with are mounting trade deficit, real economic growth is impossible. I concede we have seen some innovations i.e the ipod, ipad etc and some more in the electronics world over the last decade, but these are minute relative to the structurally weak economy that is the United States.

Back to the TMS: I follow this measure along with the supply-demand fundamentals of hard assets, namely precious metals to gauge what the current fair value of these should be (give or take). Of course this isn’t an exact science but it can’t hurt to look at. My personal approach is to estimate what the fair value was in 1973 (a few years post Bretton woods) and adjust according to the TMS for a base case price. This is because I’m certain it will continue to increase at an accelerating rate because this inflation tsunami that is brewing will only continue to grow before it strikes.

Parallels to The Past: Here’s is an excerpt from pre revolutionary France:

From the early reluctant and careful issues of paper we saw, as an immediate result, improvement and activity in business. Then arose a clamor for more paper money. At first, new issues were made with great difficulty; but, the seal once broken, the current of irredeemable currency poured through; and, the breach thus enlarging, this currency was soon swollen beyond control. It was urged on by speculators for a rise in values; by demagogues who persuaded the mob that a nation, by its simple fiat, could stamp real value to any amount upon valueless objects. As a natural consequence a great debtor class grew rapidly, and this class gave its influence to depreciate more and more the currency in which its debts were to be paid. The government now began, and continued by spasms to grind out still more paper; commerce was at first stimulated by the difference in exchange; but this cause soon ceased to operate, and commerce, having been stimulated through inflation, wasted away. Manufactures at first received a great impulse; this overproduction and over stimulus proved as fatal to them as to commerce. From time to time there was a revival of hope caused by an apparent revival of business; but this revival of business was at last seen to be caused more and more by the desire of far-seeing and cunning men of affairs to exchange paper money for objects of permanent value. As to the people at large, the classes living on fixed incomes and small salaries felt the pressure first, as soon as the purchasing power of their fixed incomes was reduced. Soon the great class living on wages felt it even more sadly. Prices of the necessities of life increased: merchants were obliged to increase them, not only to cover depreciation of their merchandise, but also to cover their risk of loss from fluctuation; and, while the prices of products thus rose, wages, which had at first gone up, under the general stimulus, lagged behind. Under the universal doubt and discouragement, commerce and manufactures were checked or destroyed. As a consequence the demand for labor was diminished; laboring men were thrown out of employment, and, under the operation of the simplest law of supply and demand, the price of labor—the daily wages of the laboring class—went down until, at a time when prices of food, clothing and various articles of consumption were enormous, wages were nearly as low as at the time preceding the first issue of irredeemable currency. The mercantile classes at first thought themselves exempt from the general misfortune. They were delighted at the apparent advance in the value of the goods upon their selves. But they soon found that, as they increased prices to cover the inflation of currency and the risk from fluctuation and uncertainty, purchases became less in amount and payments less sure; a feeling of insecurity spread throughout the country; enterprise was deadened and stagnation followed. New issues of paper were then clamored for as more drams are demanded by a drunkard. New issues only increased the evil; capitalists were all the more reluctant to embark their money on such a sea of doubt. Workmen of all sorts were more and more thrown out of employment. Issue after issue of currency came; but no relief resulted. All men were waiting; stagnation became worse and worse. At last came the collapse and then a return, by a fearful shock, to a state of things which presented something like certainty of remuneration to capital and labor. ‘There is a lesson in all this which it behooves every thinking man to ponder.”[3]

-Buy Gold(

GLD) and Silver(

SLV) To Protect Your Wealth

[1] Hoppe,Hans H., The Ethics Of Private Property, pg 42

[2] Hoppe,Herman H. The Ethics Of Private Property, pg.45

[3] White, Andrew, Fiat Money Inflation In France, pg 63